Do u want to check your PF balance( also known as EPF balance) then you have chosen the right place.

The EPF(Employees’ Provident Fund) is a scheme in which your saving will be kept and will be available for you after retirement or joining another job. In this scheme, an employee pays a certain contribution towards the scheme, and the same amount of contribution is also paid by the employer.

As an employee, there are certain things that one would like to know about their Employee provident fund(EPF), like what is the interest of their EPF.

EPF scheme manages under Employee Provident Fund Organization (EPFO). The employee will get a sum of their amount and the contributed amount given by the employer with interest on both after getting retired.

Here we have provided you with some ways to check your PF balance.

Page Contents

How to check PF balance with UAN Number

If you want to check your EPF balance, first you have to make sure that your employer has activated your Universal Account Number(UAN). UAN number is a 12-digit unique identification number provided for all employees. You must have a single UAN number if you have multiple UAN numbers then deactivate all UAN numbers except the recent one.

When your UAN number gets activated then go through the following steps to check your PF balance.

First, go to the official website from any browser then click on “Service” tab. After that click on “For Employees“, and then click on “Member Passbook“. Now Login to your account then select your Member Id.

- click on Service tab.

- click on “For Employees”.

- click on “Member Passbook”.

- Login.

- Select Member Id.

Let’s explore these steps one by one to understand it clearly.

1. click on Service tab

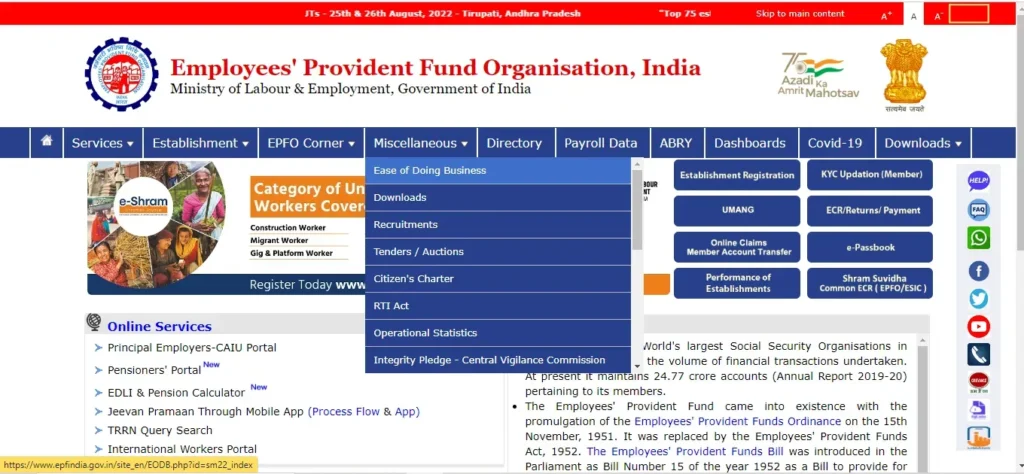

first you have to go to the official website “epfindia.gov.in“, then a screen will show up like the below one, then click on the Service tab.

2. click on “For Employees”

After clicking on the “Services” tab a drop-down menu will show up, click on “For Employees”.

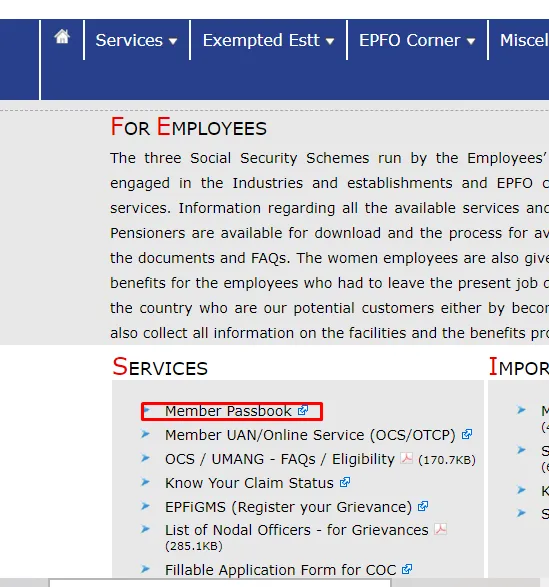

3. click on “Member Passbook”

On the new page click on “Member passbook” as shown in the below image.

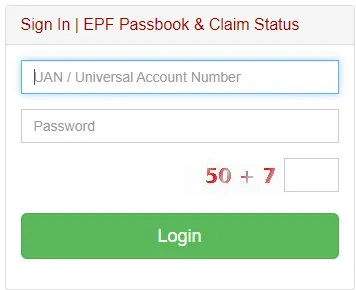

4. Login

After that, a login page will appear on the screen. Enter your UAN number after activation. Enter your password then enter the given Captcha and click on the “Login” button.

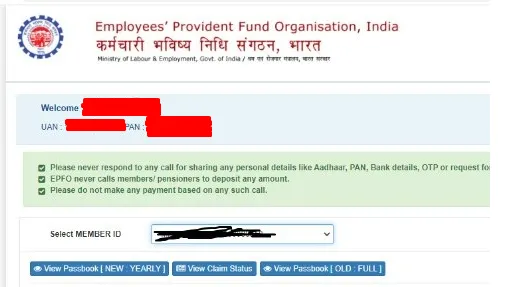

5. Select Member Id.

Now a new page will appear where you will be able to see your name, PAN number, and Aadhar number. Now select the member Id and finally you will be able to see your PF balance.

How to check PF balance without UAN Number

Here we have provided a list to check your EPF balance without using your UAN number.

- Via SMS.

- By giving a missed call.

- Going through Umang app.

# Via SMS

When employees have activated their UAN. They can check their PF balance by sending an SMS to 7738299899. The format of the SMS should be EPFOHO UAN ENG. The last three letters Prefer the language that you wanted to receive details in.

In this period there are several languages in which you can receive SMS details like English, Hindi, Bengali, Malayalam, Kannada, Tamil, Telugu, Marathi, Gujarati, and Punjabi. In case you want your details in Tamil then the SMS format should be like EPFOHO UAN TAM.

NOTE: This service will be available to employees if the PAN, Aadhar, and bank details of the employees must be linked with their UAN number.

#By giving a missed call

Employees can also check their PF balance by giving a missed call to 011-22901406 from their registered mobile number. But to avail of this service, the employee’s Aadhaar, Permanent Account Number (PAN), and bank account details must be linked with their UAN.

Note: If the above details are not linked with their UAN number, the employee will have to request the employer to link the PAN number, Aadhar number, and bank details.

#Going through Umang app

To check your PF balance through an app first you have to download the Unified Mobile Application for New-age Governance (UMANG) app, from this app employees will be able to check the PF balance on their mobile. Not only you can check the PF balance but you can also file and track claims. This app allows you to do this.

To access this app members must complete a one-time registration by using their UAN registered mobile number.

Q1-Can you check the PF balance with an Aadhaar number?

No, you cannot check the PF balance with an Aadhar number. By only using the UAN number you will be able to check your PF balance.

Q2-How can I claim my PF amount?

You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership.

Retention of the membership will give the advantage of adding any future period of membership under the Fund and attaining eligible service of 10 years to get a pension.

Q3-Can I withdraw 100% PF amount?

As per the rule, you can withdraw 100% of your PF only after 2 months of unemployment. PF withdrawal is exempted from tax but only in certain conditions. Tax exception is only allowed to the employee who contributed to the PF account for 5 years.

Q4-How long PF claim takes?

Generally, it takes 20 days to release or claim your PF amount.

Q5-Can I withdraw my PF after leaving a job?

you cannot immediately withdraw your PF account balance after leaving a job. If you want to withdraw your PF amount before the period of five-year, then you have to pay tax on the amount.

Conclusion:

I hope you are not going to search “how to check your PF balance” again after this. I think you have fully understood to “check PF details“.

I have told you 2 methods to check your PF balance 1: With UAN Number, and 2: Without a UAN number. You can also see the video which I have provided you for a better understanding.

If you still have any queries regarding this matter you can tell me in the comment.

If your problem have been resolved and find this helpful than share this with your friend and relatives.

After finishing this you can also check the following Aticles