Are you looking for the best health insurance companies in the US? Want to find the best?

Finding the best insurance companies for your health can be a challenging task or like solving a complex puzzle, there are dozens of health insurance companies providing services.

But due to their diverse fee structure, plans, facilities, and coverages, you may confused about picking the right one, however, it is important to choose the right one according to your needs.

We’ve done extensive research to find the facts, data, growth, and overview of these companies. In this article, you will get to know all about these insurance companies.

Page Contents

How to compare the best companies

Before considering/purchasing a policy from an insurance company, need to understand the requirements, facilities, eligibility, benefits, and other relevant information.

Comparison is the best method to consider the best company.

What you should consider:

- Budget

- Coverage

- Customer service

- Network of Hospitals/Garages

- Policy benefits

- Reputation

- Customer rating/reviews

Once you know the top companies, visit their service pages, check the pricing plan and included facilities, and then check the online ratings and reviews to learn the customer’s satisfaction with the service.

Best Health insurance companies in the USA

Each year the company’s ranking is changed – you can check them online, but the question is what are the best, which provides the best and affordable service?

According to a recent analysis by (USA TODAY), Kaiser Permanente is the best health insurance company in (2024).

- Kaiser Permanente (best overall)

- Aetna (best for young adults)

- Blue Cross Blue Shield (Suitable for self-employed)

- UnitedHealthcare (Good provider network in 2024)

To learn more about the company overview, customer rating (NCQA quality rating), pros and cons, service plans, cost, and complaint level, you can visit the official website (usatoday.com).

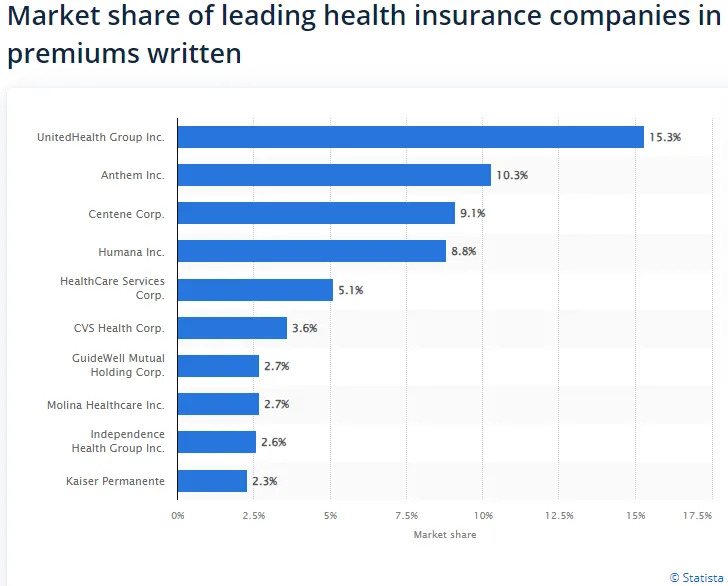

According to a research report by (Statista) in the United States (2021), the leading health insurance companies’ market share total valuation was approximately U.S. 137.8 billion dollars.

The market leader was UnitedHealth Group Inc with 15.3% market shares, here you can see the graph of top companies, must visit the official website.

According to company offerings, they are categorized; based on – overall, affordability, discounts, customer reviews, company growth, pricing structure, etc).

Here is the table of top leading health insurance companies in the USA and their market share.

| Rank | Company Name | Market Share |

|---|---|---|

| 1 | UnitedHealth Group Inc. | 15.3% |

| 2 | Anthem Inc. | 10.3% |

| 3 | Centene Corp. | 9.1% |

| 4 | Human Inc. | 8.8% |

| 5 | HealthCare Services Corp. | 5.1% |

| 6 | CVS Health Corp. | 3.6% |

| 7 | GuideWell Mutual Holding Corp. | 2.7% |

| 8 | Molina HealthCare Inc. | 2.7% |

| 9 | Independence Health Group Inc. | 2.6% |

| 10 | Kaiser Permanente | 2.3% |

Largest Health Insurance Companies by State

In the United States, health insurance is a primary of healthcare access, as we’ve mentioned the top 10 key players according to their market share.

Company popularity depends on many factors, however, each state has its own set of largest health insurance companies, which provide coverage to residential people.

You can understand the services, offers, facilities, and fee structure by visiting individual company official webpages, which will help to make informed decisions.

Here are some largest players in each state, according to reports by ValuePenguin.

| State | Largest Health Insurance Companies |

|---|---|

| Alabama | BCBS of Alabama, UnitedHealthcare |

| Alaska | Premera BCBS of Alaska |

| Arizona | BCBS of Arizona, UnitedHealthcare |

| Arkansas | Arkansas BCBS, Centene Corporation |

| California | Anthem Blue Cross, Kaiser Permanente, Blue Shield of California |

| Colorado | Anthem BCBS, Kaiser Permanente |

| Connecticut | Anthem BCBS, ConnectiCare |

| Delaware | Highmark BCBS, Aetna |

| Florida | Florida Blue, UnitedHealthcare, Humana |

| Georgia | BCBS of Georgia, Kaiser Permanente |

| Hawaii | HMSA (Hawaii Medical Service Association), Kaiser Permanente |

| Idaho | Blue Cross of Idaho, PacificSource |

| Illinois | BCBS of Illinois, Health Care Service Corporation |

| Indiana | Anthem BCBS, UnitedHealthcare |

| Iowa | Wellmark BCBS, UnitedHealthcare |

| Kansas | BCBS of Kansas, Sunflower State Health Plan |

| Kentucky | Anthem BCBS, Humana |

| Louisiana | BCBS of Louisiana, Humana |

| Maine | Anthem BCBS, Harvard Pilgrim Health Care |

| Maryland | CareFirst BCBS, Kaiser Permanente |

| Massachusetts | BCBS of Massachusetts, Tufts Health Plan |

| Michigan | BCBS of Michigan, Priority Health |

| Minnesota | BCBS of Minnesota, Medica |

| Mississippi | BCBS of Mississippi, UnitedHealthcare |

| Missouri | Anthem BCBS, Centene Corporation |

| Montana | BCBS of Montana, PacificSource |

| Nebraska | BCBS of Nebraska, UnitedHealthcare |

| Nevada | Anthem BCBS, Health Plan of Nevada |

| New Hampshire | Anthem BCBS, Harvard Pilgrim Health Care |

| New Jersey | Horizon BCBS of New Jersey, UnitedHealthcare |

| New Mexico | BCBS of New Mexico, Presbyterian Health Plan |

| New York | Empire BCBS, Healthfirst, Excellus BCBS |

| North Carolina | BCBS of North Carolina, UnitedHealthcare |

| North Dakota | BCBS of North Dakota, Sanford Health Plan |

| Ohio | Anthem BCBS, Medical Mutual of Ohio |

| Oklahoma | BCBS of Oklahoma, UnitedHealthcare |

| Oregon | Regence BCBS, Kaiser Permanente |

| Pennsylvania | Independence Blue Cross, Highmark BCBS |

| Rhode Island | BCBS of Rhode Island, UnitedHealthcare |

| South Carolina | BCBS of South Carolina, Molina Healthcare |

| South Dakota | Wellmark BCBS, Avera Health Plans |

| Tennessee | BCBS of Tennessee, Cigna |

| Texas | BCBS of Texas, UnitedHealthcare |

| Utah | Regence BCBS, SelectHealth |

| Vermont | BCBS of Vermont, MVP Health Care |

| Virginia | Anthem BCBS, Optima Health |

| Washington | Premera BCBS, Kaiser Permanente |

| West Virginia | Highmark BCBS, Health Plan of West Virginia |

| Wisconsin | Anthem BCBS, WPS Health Insurance |

| Wyoming | BCBS of Wyoming, WINhealth |

Depending on your state and location you can check the individual company’s specifications, reputation, and facilities.

First of all, understand what makes a “Good” health insurance company:

- Affordability: Check the total cost of the insurance policy plan (monthly premiums, deductibles, and out-of-pocket maximums).

- Network of providers: A good network of doctors, hospitals, and specialists is necessary to care for the person, and to provide the best quality service to cure health-related issues.

- Customer service reputation: The company should have a good customer service track record, check online customer ratings, and review their other coverages.

- Plan benefits: With basic coverage, identify what additional benefits are offered by their plan – such as mental health coverage, maternity care, vision, dental, etc.

These are the primary factors, however you can research more to compare the plans. Many online resources are available, that can help you for comparing the plans of different companies.

FAQs

Here are some Frequently Asked Questions related to health insurance queries.

Which health insurance company is best?

The best company for health insurance depends on individual needs, but according to recent research, Kaiser Permanente is the best company overall.

Who is the number 1 health insurance in the US?

Kaiser Permanente has the most total health enrollments in the US.

Which health insurance covers all 50 states?

Several national health insurance companies cover all 50 states, including Aetna, Blue Cross Blue Shield, and Cigna.

Is health insurance mandatory in the USA?

No, health insurance is not mandatory at the federal level. However, there may be tax penalties for not having coverage.

What should I consider when choosing a health insurance plan?

When choosing health insurance consider your budget, preferred doctors/hospitals, healthcare needs, level of coverage, company reputation, customer service, etc.

Wrapping up

Blue Cross Blue Shield, Aetna, and UnitedHealthcare are the best companies for health insurance in the USA, but Kaiser Permanente is best for overall service.

Before you consider for insuring your health, and when choosing a company, check the eligibility, requirements, and facilities.

We’ve just provided the information that you need to know about the best insurance company. If there are any doubts regarding the blog post, then comment to us.

May you like: